TABLE OF CONTENTS

Employment Law 2017 Year in Review

Sexual Harassment Cases Capture National Headlines

Immigration Law Changes and How They May Impact Your Business

EEOC’S Priorities Remain Consistent in 2017

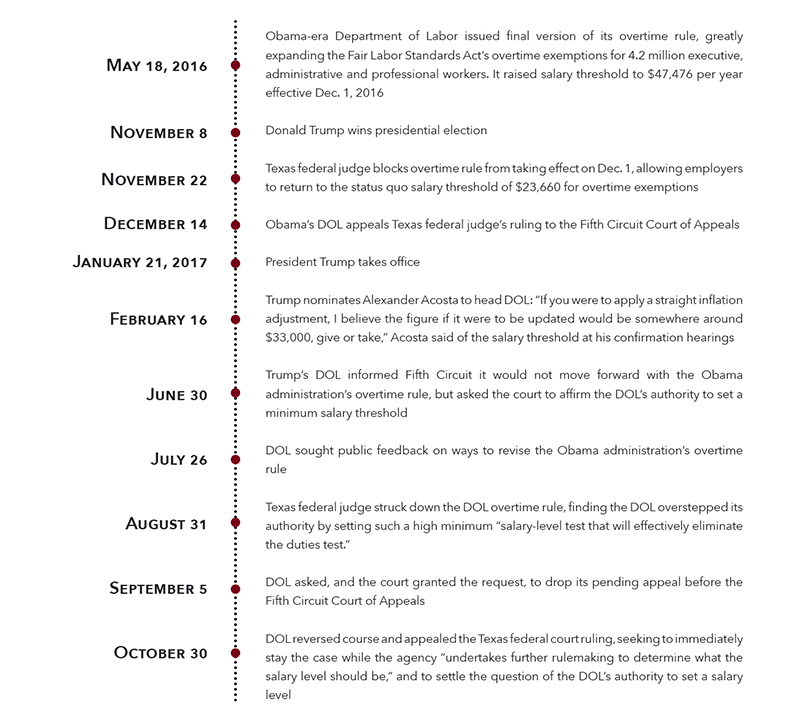

Tracking the Rise, Fall & Rise Again of Federal Overtime Regulations

Curbing Workers’ Compensation Exposure without an IRE

Shifting Focus at the NLRB

Employment Cases Come Fast & Furious at Third Circuit

Beyond The ACA and the Fiduciary Rule – Employee Benefits After 2017

Employment Law 2017 Year in Review

By: Jennifer Craighead Carey, David J. Ledermann, Silas M. Ruiz-Steele, Joshua L. Schwartz, Jill Sebest Welch, David M. Walker and Michael J. Crocenzi

Related Practice Areas: Employment Employee Benefits, Employment Litigation, Immigration and Labor Law and Litigation

Click here to view “Employment Law 2017 Year in Review”

Sexual Harassment Cases Capture National Headlines

By: Joshua L. Schwartz

Related Practice Area: Employment Employment Litigation

In the closing months of 2017, you couldn’t pick up a paper or check your Facebook newsfeed without reading two words: Sexual harassment.

While the buzz and publicity on the issue has been mainly contained to the worlds of politics, media and entertainment, with recognizable names such as Harvey Weinstein, Kevin Spacey, and Louis C.K. all facing reprehensible, career-threatening accusations of sexual harassment, the #MeToo movement transcends these industries. The movement is inspiring countless women (and men) who have been subjected to decades worth of shameless acts of sexual harassment to come forward, share their stories, and hold accountable those who violated the societal – and legal – rules of common decency.

The past can’t be changed. But employers, whether they have been affected by accusations of sexual harassment in the workplace recently or not, should look at this as an opportunity to keep it from happening going forward and making sure the company is protected from future claims.

Use some of these basic tools to keep your company free from the scourge of sexual harassment:

Education and training: Many companies already have gone through the process of holding a sexual harassment training seminar for employees. But does your company’s training rely solely on an outdated video, or does it go beyond a “check the box” approach to include concepts like unconscious bias, bullying, and workplace civility? Ensuring adequate training is a necessary step to make sure all in the company understand the severity of sexual harassment and your company’s stance on it.

Review your policies: Take this opportunity to review your sexual harassment policy, open door policy and other non-discrimination provisions of your handbook to ensure legal compliance.

Appropriately handle complaints: Promptly investigate all claims, and do not let a supervisor’s productivity or tenure get in the way of appropriate discipline when you find a credible complaint of harassment. Tolerating an employee who makes inappropriate jokes or is too physical with other employees because “that’s just the way he is” can get an employer into trouble if another employee takes these actions “the wrong way.” Consider holding a separate training for management and executive teams that directly addresses not only how those individuals should behave towards those they manage, but also how to investigate and address reports of sexual harassment.

With the social media-fueled publicity behind the movement to expose workplace sexual harassment, we expect accusations to increase. When an accusation has merit, a company can avoid liability and improve workplace morale by performing a prompt investigation and adequately addressing the problem.

If you have any questions about your company’s current sexual harassment policy or practices, please contact me or any of the attorneys in Barley Snyder’s Employment Practice Group.

Immigration Law Changes and How They May Impact Your Business

By: Silas M. Ruiz-Steele

Related Practice Area: Employment Immigration

The early focus on immigration and border security from President Trump’s administration brought significant changes for U.S. employers and their workforce.

With a new administration came new policy memorandums and new executive orders with far-reaching effects on most areas of immigrant and non-immigrant visas. In addition, we are seeing an increase in workplace inspections as well as a new I-9 form. There is a recent new requirement for in-person interviews with U.S. Citizenship and Immigration Services (USCIS) for employment-based green cards, and increased scrutiny of employment-based visa petitions.

For Barley Snyder’s Immigration Practice Group, this has meant staying on top of policy changes affecting how we file for visa petitions and responding to increased requests for evidence.

Some of the biggest changes:

New Form I-9

The USCIS issued a new version of Form I-9 in July. Employers have been required to use the updated version of Form I-9 since September 18 to verify the identity and employment authorization of individuals hired for employment in the U.S. Employers must continue to follow existing storage and retention rules for any previously completed Form I-9.

E-Verify

Mandatory E-Verify is gaining popularity. If passed, the Legal Workforce Act, first introduced on September 8, would make E-Verify use mandatory for employers over a twoyear phase-in period. The bill includes granting a safe-harbor to employers who use E-Verify in “good faith” and raises penalties for knowingly employing unauthorized workers.

Increase in Worksite Enforcement

In his “Buy American, Hire American” executive order, Trump made enforcement of the nation’s immigration laws a primary focus. Employers should expect an increase in the number of workplace inspections by U.S. Immigration and Customs Enforcement (ICE) as part of a stepped-up effort at immigration enforcement of the workplace in 2018 and beyond. Employers must make sure that their I-9 forms are completed correctly, ensuring that all new hires are authorized to work in the U.S. and follow existing storage and retention rules. Failure to properly complete and retain I-9 forms opens an employer to fines. Each employer must complete a Form I-9 for every employee hired after November 6, 1986.

In light of the projected increase in workplace investigations, employers should be prepared:

- Review I-9 processes and policies so they are up to date with the recent best practices changes.

- Perform a self-audit of all I-9 forms to ensure each employee has a compliant I-9 on file. The audit should include I-9 forms for all current employees as well as those I-9 forms for terminated employees, according to existing storage and retention rules.

- Develop a comprehensive I-9 compliance program to include training of those responsible for handling the Form I-9 process.

USCIS In-Person Interviews for Employment-Sponsored Green Cards

In-person interviews are now required for all employment-sponsored green card applications filed after March 6, 2017. Each family member – including children 14 and older – will be asked to appear at the local USCIS office for the interview. According to the USCIS news release, “Conducting in-person interviews will provide USCIS officers with the opportunity to verify the information provided in an individual’s application, to discover new information that may be relevant to the adjudication process, and to determine the credibility of the individual seeking permanent residence in the United States.” Employment-sponsored green card applicants should prepare for their in-person interviews by becoming familiar with the information as stated in the forms, applications and evidence used for the particular immigration benefit and employers should help them. The applicant also should be prepared to articulate:

- Employer

- Position offered, including the specific duties as related to their job description, salary and location

- Education and any related experience

- Maintenance of status in the U.S.

Family members of the principal applicant should expect questioning regarding their relationship to the principal and should be prepared to establish the bona fide nature of that relationship.

Obtain an Employment Authorization Document and Social Security Number Simultaneously

According to an October news release, USCIS and the Social Security Administration announced a new, streamlined process for foreign nationals in certain categories or classifications to apply for work authorization and a social security number using a single form – the updated Form I-765, Application for Employment Authorization. To lawfully work in the United States, foreign workers in some categories and classifications need both an employment authorization document from USCIS and a Social Security number. The revised Form I-765 includes additional questions that allow applicants to apply for a Social Security number or replacement card without visiting a Social Security office.

Increased Scrutiny of Nonimmigrant Visa Petitions

USCIS issued an October policy memorandum instructing its adjudicating officers to apply the same level of scrutiny to both initial petitions and extension requests for certain non-immigrant visa categories. Employers can no longer rely on prior USCIS determinations of eligibility when adjudicating their extension of stay petitions. USCIS makes it clear that under the law, the burden of proof in establishing eligibility for the visa petition extension is on the petitioning employer, regardless of whether USCIS previously approved a petition. The adjudicator’s determination is based on the merits of each case, and officers may request additional evidence if the employer has not submitted sufficient evidence to establish eligibility. Going forward, employers filing non-immigrant visa extensions will want to make sure they meet this burden of proof.

Expect Increased Scrutiny at U.S. Consulates and Ports of Entry

Employers should be prepared to expect more scrutiny of their foreign national employees when traveling on non-immigrant visas, whether at U.S. ports of entry or when applying for their non-immigrant visa stamp at U.S. consulates overseas. This increased scrutiny will also create delays, especially at consular offices overseas. Employers and their foreign national employees should plan ahead to avoid any interruptions at work.

If anyone has questions on how the new immigration laws will affect their business, please contact me or any of the attorneys in Barley Snyder’s Immigration Practice Group.

EEOC’S Priorities Remain Consistent in 2017

By: Jennifer Craighead Carey

Related Practice Area: Employment Employment Litigation

Despite administration change, the Federal Equal Employment Opportunity Commission’s (EEOC) priorities in 2017 remained consistent with prior strategic enforcement initiatives. Moreover, at the end of the agency’s 2016 fiscal year on September 30, the number of lawsuits it filed actually increased from the prior fiscal year. One clear priority of the EEOC in 2017 was its continued focus on Americans with Disabilities Act (ADA) compliance. Of the 88 lawsuits filed by the EEOC in September of 2017, 77 of those cases were filed under the ADA and most involved allegations of failure to accommodate.

Among the cases filed by the EEOC was a failure to accommodate case involving Home Depot, alleging that company failed to accommodate an employee with irritable bowel syndrome and fibromyalgia with short breaks to care for herself. In another case, the EEOC sued Jackson Energy alleging failure to accommodate after the company placed a dispatcher on medical leave and subsequently terminated her following wrist surgery. The EEOC claimed that Jackson Energy should have considered speech recognition software as an accommodation which would have allowed the employee to continue to perform her dispatch duties. In yet another case, the EEOC sued a residential rehabilitation facility for allegedly failing to provide temporary light duty to a nursing assistant who experienced a temporary flare up in her rheumatoid arthritis due to a medication issue. Recently, the EEOC submitted an amicus brief in support of an employee in a case against a Pennsylvania health care institution for failure to accommodate under a mandatory vaccination policy. The EEOC took the position in its brief that the health care institution should have excused the employee from receiving the “Tdap” vaccine because of her anxiety and other medical issues even though Centers for Disease Control guidelines and the manufacturer’s literature did not appear to support the employee’s condition as exempt from the vaccine.

The EEOC also continued its focus on LGBT discrimination. Although the U.S. Department of Justice under the Trump administration has staked out the position that LGBT discrimination is not protected under Title VII’s sex discrimination prohibitions, the EEOC continues to assert that Title VII protects LGBT individuals from employment discrimination. In September, the EEOC filed suit against a chain of auto shops in Colorado alleging a failure to hire claim under Title VII. The company withdrew a job offer to a candidate after learning the candidate was transgender. The EEOC has stated that LGBT discrimination protections will remain a priority enforcement area through 2021.

The commission also recently approved an updated strategic enforcement plan for fiscal years 2017-2021 that continues to prioritize the following issues:

- Eliminating barriers in recruitment and hiring

- Protecting vulnerable workers, including immigrant and migrant workers, and underserved communities from discrimination

- Addressing selected emerging and developing issues

- Ensuring equal pay protections for all workers

- Preserving access to the legal system

- Preventing systemic harassment

One issue that has garnered its share of public attention this year has been workplace harassment, with particular focus on sexual harassment following allegations of sexual harassment involving several high profile individuals. In June 2016, the EEOC’s Select Task Force on the Study of Harassment in the Workplace issued a report following its study of harassment in the workplace. Among the findings was that workplace harassment remains a persistent problem and too often goes unreported. The report concluded, among other things, that there is a strong correlation between workplace civility and workplace harassment and recommended that organizations conduct workplace civility training and bystander intervention training as part of their commitment to preventing workplace harassment.

As a follow up to its report this year, the agency issued proposed enforcement guidance on unlawful harassment, which directs employers to implement programs to address known or obvious risks of harassment. Although the guidance does not have the effect of law and has not yet been implemented, the EEOC suggests that failure to implement effective workplace harassment programs may result in the employer’s loss of affirmative defenses or a charge of workplace harassment. The guidance identifies “promising practices” the EEOC believes are necessary to prevent and address harassment including:

- Committed leadership

- Demonstrated accountability

- Strong, comprehensive policies

- Trusted and accessible complaint procedures

- Regular, interactive training tailored specifically to the audience and the organization

The commission’s focus on workplace harassment and the urgency around implementing best practices was made even clearer in 2017 by a July U.S. Third Circuit Court of Appeals decision. The case held that employers could be liable for racial harassment based on a single incident. In particular, the court found that a single racial slur, if severe enough, could establish a racially hostile work environment. The court noted that the conduct at issue did not have to be severe and pervasive to constitute a hostile work environment, but rather the correct standard was severe or pervasive. A single allegation of severe harassment is enough to meet the legal definition of a hostile work environment, according to the court decision.

Although the EEOC has renewed its commitment to ensuring equal pay, the Office of Budget Management, through its authority under the Paperwork Reduction Act, stayed the EEOC’s pay data collection requirements for the EEO1 report in August that were to become effective March 31, 2018. The decision of the office to immediately suspend this requirement does not affect the EEOC’s stated priority to pursue litigation for equal pay violations.

Given the EEOC’s priorities in 2017 and its strategic enforcement initiatives through 2021, employers must remain vigilant in their hiring and pay practices, ADA compliance and ensuring protections for LGBT individuals. They must also critically audit their anti-harassment policies and training programs, ensuring clear reporting procedures and underscoring workplace civility.

Our employment law attorneys regularly review anti-harassment policies and provide training on issues such as antiharassment and workplace civility, ADA compliance and best practices in hiring. Please contact a member of the group for assistance.

Tracking the Rise, Fall & Rise Again of Federal Overtime Regulations

By: Jill Sebest Welch

Related Practice Area: Employment Employment Litigation

As of the end of 2017, employers should anticipate a proposed new overtime rule at some point in 2018, with a salary-level test closer to the mid-$30,000 range. In addition, the DOL may tackle revisions to the oft-maligned administrative duties test, and address the substantive questions posed in its request for feedback:

- Should multiple salary levels be set to account for employer size and geographical regions?

- Should different salary levels be considered for each of the executive, administrative and professional exemptions?

- Would it be preferable to base the exemption entirely on the duties test without regard to the salary paid by an employer?

- Should non-discretionary bonuses and incentive payments be counted towards an employee’s salary?

- How should the highly compensated employee salary level be set?

- Should the salary thresholds be automatically updated on a periodic basis?

Companies that waited to implement a new salary threshold for exempt employees can take steps in the new year to plan for the changes. They should survey workloads of current salaried exempt positions falling below $32,000 and update job descriptions and evaluate essential duties for exempt positions. In addition, they should consider the business impacts of increasing pay to meet a new salary threshold, converting exempt employees to hourly pay or reducing workloads to meet a 40-hour work week.

Training on wage and hour issues for both management and employees should also be a focus in 2018. The training should include timekeeping and off-the-clock work, handling exceptions to schedules and breaks, and proper and improper salary and wage deductions.

If any employer has questions on how a new iteration of the overtime rule proposals could affect them, please contact me or any member of Barley Snyder’s Employment Practice Group.

Curbing Workers’ Compensation Exposure without an IRE

By: Joshua L. Schwartz

Related Practice Area: Employment Employment Litigation and Workers’ Compensation

The biggest bombshell of change in decades of Pennsylvania workers’ compensation law exploded in June when the Pennsylvania Supreme Court declared impairment rating evaluations (IREs) unconstitutional. That now-watershed decision has deprived employers and insurers of one way to avoid indefinite disability payments. Though legislative efforts may be underway to restore the IRE, now is a good time for employers to re-examine the other tools available to them.

Since 1996, the Workers’ Compensation Act has permitted insurance companies to request an injured worker undergo an IRE once the employee has received 104 weeks of temporary total disability benefits. The state’s Bureau of Workers’ Compensation would then assign the IRE to a physician, who would use the latest version of the American Medical Association Guide to the Evaluation of Permanent Impairment to determine the injured worker’s level of “impairment.” So long as the injured worker had reached maximum medical improvement and was determined to be less than 50 percent impaired by the work injury, the benefits would be converted to a partial rate payable for 500 additional weeks. The IRE process thus effectively provided a cutoff after 604 weeks for injured workers who had permanent restrictions due to their work injury.

In Protz v. WCAB (Derry Area School District), the Pennsylvania Supreme Court held that use of the AMA Guide improperly delegated legislative authority to the American Medical Association. An injured worker’s level of impairment is therefore now irrelevant to receipt of benefits. Despite the decision, several means of limiting long-term exposure remain available to employers.

Bringing the Employee Back to Work

Since benefits in Pennsylvania are a function of an employee’s ability to work, employers with robust returnto-work and light duty programs see fewer employees receiving benefits for extended periods of time. Employers cannot reserve bona fide jobs for injured workers without running afoul of the Americans with Disabilities Act. However, providing temporary lightduty positions exclusively to injured workers is permissible and may be preferable to paying employees while they sit at home (presumably watching commercials advertising plaintiffs’ attorney law firms, according to some of my clients). Keeping an injured worker occupied in the workplace has benefits for morale and typically permits a quicker transition back to pre-injury job duties or, at least, to a baseline set of permanent restrictions.

The most successful return-to-work programs have meaningful, functional job descriptions that include breakdowns of required physical capabilities. These job descriptions can then be attached to job offer letters or sent to treating physicians for approval before job offers are made. It may even be helpful to film someone performing the required job tasks so there is a clear record of what would be required by the injured worker.

When an injured worker refuses in bad faith to return to work within restrictions, an employer can ask a judge to suspend benefits. Because of the burdens of proof in suspension proceedings, employers should ensure that modified duty job offers are made in writing and include:

- Start date, time and location

- Hours and rate of pay

- Contact information for the employee to confirm the return to work

- The latest medical release setting forth the employee’s restrictions

- Job description or analysis, with an indication of how the employer will modify the job duties to accommodate any restrictions

Job offers should also be coordinated with the workers’ compensation carrier to ensure the appropriate bureau document — the “Notice of Ability to Return to Work” — precedes the formal offer letter. Managing injured workers on modified duty is just as important as crafting an appropriate job offer. Injured workers should be assured the company will comply with their medical restrictions and be instructed that if they are asked to do anything they believe is outside those restrictions, they should decline and speak to human resources. Employers should also follow up periodically to ensure they have the most up-to-date restrictions and, when possible, alter the job duties to increase the physical tasks required as an injured worker’s physical capabilities increase. Employers should limit temporary, non-bona fide, light-duty positions to a reasonable period.

Earning Power Assessment and Labor Market Survey

Despite the success of return-towork programs, many employers do not have the capacity or flexibility to provide long-term accommodation of permanent restrictions. To avoid paying benefits indefinitely, these employers should consider speaking with their carrier about earning power assessment, which permits employers unable to make work available to modify or suspend benefits by making job referrals to injured workers. The process starts with an employer or carrier retaining a vocational expert to interview the injured worker to determine education level and experience. The expert then reviews the worker’s physical capabilities and performs a labor market survey, researching job openings within the region the injured worker is qualified for. The expert refers several jobs, culminating with an earnings power assessment report. If the injured worker obtains a job, the benefits are modified or suspended as if earnings were coming from the time-of-injury employer. If the injured worker fails to follow up appropriately, the benefits are modified or suspended as if the worker had obtained one of the referred positions.

Because earning power assessment has often arisen against the background of an IRE and as a precursor to settlement discussions, employers and carriers have sometimes not considered it as seriously as they should. Ideally, the vocational expert should have an in-person meeting with the injured worker before researching jobs and should then relatively quickly research openings in the area, sending referrals to the injured worker as they are discovered rather than waiting to issue a formal report. The final report then becomes a true summary of a bona fide, vocational, referral process. Following this procedure is often key to obtaining a modification or suspension of benefits through litigation, if the injured worker fails to follow through on the referrals. Now that IREs are no longer a viable limitation, employers should take extra care that these assessments are performed appropriately.

Settlement

Settlement remains a viable option, though the lack of an IRE option may raise settlement values for difficult cases. Evaluation of settlement possibilities is often more art than science and relies on a variety of factors, including the significance of the injury, the injured worker’s desire and ability to find alternative employment, and the existence of other benefits that may provide ongoing income. A job offer, earnings power assessment or pending independent medical examination can also provide leverage for an employer seeking to settle a case, as they increase the possibility that the injured workers’ benefits may be modified or suspended absent a resolution.

The attorneys at Barley Snyder regularly consult with employers to discuss return to work programs, retention of vocational experts, settlement, and other strategies for limiting workers’ compensation exposure. If you have questions or concerns regarding your options under the workers’ compensation act, do not hesitate to contact any of the attorneys in our Workers’ Compensation group.

Shifting Focus at the NLRB

By: David M. Walker

Related Practice Area: Employment Labor Law and Employment Litigation

For both management and labor, 2017 initiated a sea change in labor relations that will reverberate for years. Most notably, the new federal administration took steps to change the direction of the National Labor Relations Board (NLRB). The U.S. Senate confirmed new NLRB members – Marvin Kaplan and William Emanuel – who tip the scales to make the NLRB’s first Republican majority in nine years. It also returns the NLRB to a full complement of five members.

Emanuel was a management-side labor and employment lawyer in private practice, while Kaplan served as counsel to the commissioner of the Occupational Safety and Health Review Commission. It is expected that the NLRB will re-examine a multitude of decisions from the Obama-era that more expansively interpreted the National Labor Relations Act (NLRA) and generally provided more laborfriendly rulings. Included among the more recent issues that the NLRB may revisit is the expansion of what constitutes protected concerted activity and the impact of that interpretation on workplace policies, the definition of an appropriate bargaining unit and the labor rights of college/university faculty, student athletes, graduate assistants and research assistants. The NLRB’s intent to revisit certain issues came to fruition on December 14, when a divided board overturned the 2015 expansion of its test for determining joint employer status. It returned to its prior standard requiring actual control.

The Supreme Court also is taking aim at a number of high-profile labor issues. In its very first argument of the 2017-2018 term, the Court heard arguments on whether arbitration agreements that require employees to waive their rights to bring or participate in a class action violates the NLRA. These arbitration agreements historically were enforced pursuant to the Federal Arbitration Act until recently, when the Obama administration argued against their legality. This time around the Supreme Court will resolve a split in the circuit courts as to whether these agreements violate the NLRA by infringing upon employees’ rights to engage in concerted activities, and they will do so with the U.S. Department of Justice reversing course and now arguing that such waivers are lawful.

The 2017-2018 term also will see the Supreme Court again address publicsector unions collecting “fair share” fees from non-union employees. Fair share fees are ones a public-sector union can assess upon other similarly-situated employees of the same public employer who choose not to join the union. In theory, the fees serve to cover the union’s cost of collective bargaining and contract administration by requiring non-union employees to contribute towards their share of the costs since the non-union employees also benefit from the work of the union. A challenge to fair share fees that reached the Supreme Court in 2016 was resolved without a consensus due to the passing of Justice Antonin Scalia. With the addition of Justice Neil Gorsuch, the Supreme Court may be positioned to diverge from forty years of precedent and end the ability of public-sector unions to collect fair share fees.

The end of 2017 also provided employers much-needed relief in the realm of employee handbooks. The NLRB issued a decision overturning its precedent that found employer handbook provisions illegal if employees could reasonably construe such policies to prohibit them from exercising their rights under the NLRA. With a more employer-friendly ruling, the standard the NLRB will apply going forward will consider the nature and extent of a challenged policy’s potential impact on NLRA rights as well as the employer’s legitimate justifications for the policy. The NLRB’s majority reasoned that this policy shift would allow for consideration of the real-world complexities associated with employer handbooks and policies.

Employment Cases Come Fast & Furious at Third Circuit

By: Michael J. Crocenzi

Related Practice Area: Employment Employment Litigation

Case:L For the first time in years, the U.S. Supreme Court did not issue any employment-related decisions in 2017 – but stay tuned for 2018 with important employment cases on the Court’s docket.

The U.S. Court of Appeals for the Third Circuit however, had a busy year handing down decisions in the areas of harassment, discrimination and the Americans with Disabilities Act (ADA) and the Family and Medical Leave Act (FMLA):

Case: Doe v. Mercy Catholic Medical Center

Decision: An employee can sue for sex discrimination under Title IX.

A medical resident was performing her medical residency program at Mercy Catholic Medical Center in Philadelphia. She claimed the residency program director sexually harassed her and retaliated against her for complaining about his behavior. She never filed a charge with the EEOC, instead she filed a lawsuit under Title IX, which prohibits discrimination under any educational program or activity that receives federal financial assistance. Mercy Catholic Medical Center argued that Title VII was the plaintiff’s sole remedy because she was an employee of the medical center during her residency program. The court disagreed and concluded the plaintiff could pursue her claim under Title IX.

Case: Karlo, et. al v. Pittsburgh Glass Works

Decision: Age discrimination claims are valid based on a subgroup of employees.

Pittsburgh Glass Works primarily manufactures auto glass. When the auto industry faltered in 2008, the company engaged in several workforce reductions. The plaintiffs were part of a group of about 100 employees who were laid off in one reduction. They filed a discrimination claim under the Age Discrimination in Employment Act (ADEA), claiming the layoff had a disparate impact on them because they were over the 50. Typically, disparateimpact claims in ADEA cases evaluate effect of the layoff on all employees 40 and older. But the plaintiffs argued the reduction impacted a subgroup of that protected class – those over 50. The company argued that when all employees in the protected class were added to the comparison group, it washed out the statistical evidence of a disparity. The court sided with the plaintiffs and held they could pursue their statistical case based on the subgroup.

Case: Capps. V. Mondelez Global, LLC

Decision: Court dismisses FMLA retaliation case because the employer had an honest belief the employee misused FMLA leave.

The employer had a policy that prohibited employees from fraudulently using FMLA leave. The employee qualified for and was granted FMLA leave because he suffered from avascular necrosis, which occurs when there is loss of blood to the bone, and was ordered to bed rest during a flare-up. While on FMLA leave, the employee went to local pub and had a few drinks, then was arrested for DUI. He never reported the DUI to his employer, but continued to claim he could not work because of his medical condition. When the company later discovered the DUI, it fired the employee for fraudulent use of his FMLA. The employee filed a lawsuit claiming the employer retaliated against him because he used FMLA. The court dismissed the retaliation claim because the employer had an honest belief the employee misused his FMLA leave, and the employee presented no evidence to rebut this honest belief. The court also dismissed the FMLA interference claim because the employer did not withhold any FMLA benefit from the employee.

Case: Carvalho-Grevious v. Delaware State University

Decision: Prior to trial in a Title VII retaliation case, an employee only needs to claim the protected activity was the likely reason for the termination.

The employee claimed that Delaware State University fired her in retaliation for complaining that her supervisor made discriminatory remarks about her race and gender. The university argued that the employee had to allege that but for her complaints about her supervisor, she would not have been fired. The Third Circuit disagreed and held that prior to trial, the employee only had to show a possible mixed motive for the university’s actions. However, at trial the employee will need to prove that. But for her protected activity, she would not have been fired – a tougher standard than the mixed motive analysis. This ruling may make it easier for plaintiffs to survive a motion to dismiss their cases prior to trial.

Case: Castleberry & Brown v. STI Group

Decision: Third Circuit finally clarifies standard for sexual harassment cases – a single extreme event of harassment is enough.

The plaintiffs were the only two African-Americans on a work crew who claimed the crew members and supervisor had made racial remarks while on the job. Two weeks after the plaintiffs complained about this remark, the employer fired them. In reviewing the plaintiffs’ lawsuit for racial harassment, the court first cleared up the confusion about the standard to be applied in harassment lawsuits. The court held a plaintiff must prove the harassment is severe or persuasive. Because of this standard, the court agreed that even a single instance of harassment is enough to prove a violation of Title VII, but it must be “extreme enough to amount to a change in the terms and conditions of employment.” In this case, the court stated that the plaintiffs’ supervisor “used a racially charged slur in front of them and their non-African-American workers. Within the same breath, the use of this word was accompanied by threats of termination (which ultimately occurred). This constitutes severe conduct that could create a hostile work environment.”

Case: McNelis v. Pennsylvania Power Light Company

Decision: Employee could not perform the essential functions of his job because he was not fit for duty under agency regulations.

The employee worked at a nuclear power plant regulated by the Nuclear Regulatory Agency. The agency regulations required the employee to be fit for duty under the employer’s fitness for duty program. When the employee’s mental health deteriorated, he failed the fitness for duty examination and was terminated. The employee filed a lawsuit claiming the employer violated the ADA, but the court agreed with the lower court that the employee could not perform the essential functions of his job because the NRA regulations required him to be fit for duty.

Case: Williams v. Pennsylvania Human Relations Commission

Decision: Employee cannot sue individuals for race and disability discrimination under Section 1983.

The plaintiff, an employee of the Pennsylvania Human Relations Commission, claimed her supervisors discriminated against her and created a hostile working environment. Besides suing the commission, the employee sued her supervisors individually under Section 1983. The Third Circuit held that since Title VII and the ADA provide remedies for employment discrimination, the plaintiff was not permitted to sue her supervisors under Section 1983.

Case: Egan v. Delaware River Port Authority

Decision: Court allows a mixed-motive instruction for the jury to consider in an FMLA case.

The employee filed a lawsuit against his employer accusing age discrimination and retaliated against him for exercising his rights under the FMLA. A jury found there was no discrimination. On appeal, the employee argued the trial court should have allowed the jury to consider a mixed-motive instruction instead of the “but-for” instruction the judge read. The Third Circuit agreed, and under a mixed-motive analysis, an employee must prove use of FMLA leave was a “negative factor” in the employer’s adverse employment action. This is an easier burden than the “but-for” analysis.

Beyond The ACA and the Fiduciary Rule – Employee Benefits After 2017

By: David J. Ledermann

A year of mostly inconclusive legislative wrangling over the fate of the Affordable Care Act finally culminated in a year-end tax bill repealing the individual mandate. However, the ACA remains a significant compliance concern for employers, and it remains to be seen how various executive actions affecting employers under the ACA will fare in the courts, administrative agencies and insurance markets. These include an expansion of availability for exemption from the ACA’s contraceptive mandate and a proposed relaxation of restrictions on health reimbursement accounts. Meanwhile, the IRS Office of Chief Counsel reaffirmed that the ACA’s employer mandate remains effective and employers must comply with the law “until changed by the Congress.”

The fate of the U.S. Department of Labor’s new fiduciary rules governing investment advice to qualified retirement plans and their participants remains uncertain. The rules are intended to protect plan participants by enlarging the class of advisors deemed plan fiduciaries who must put the interests of participants ahead of their own. Though the rules’ basic provisions became effective June 9, enforcement has largely been delayed due to uncertainty concerning the scope of various exemptions from the rules. The DOL recently extended the applicability date for compliance with the exemption standards until July 1, 2019, which could result in additional rule changes. Impetus for relaxing, or even abandoning, the new fiduciary rules is coming from the Congress and segments of the financial services industry.

Amendments Required For Many Disability And Retirement Plans, Pending Outcome Of DOL Review

New procedures for administering claims to disability benefits under many retirement plans and group disability plans – which had been scheduled to become effective on January 1, 2018 – have been delayed through April 1, 2018. The new DOL rules amending the claims procedure regulations provide for enhanced disclosure and impartiality requirements on the part of plans and insurance carriers to better ensure plan participants receive a full and fair review of their claims. However, the DOL has provided that the new claims procedures, initially published in late 2016, would be opened up to additional public input and consideration of “regulatory alternatives other than those” previously announced. Sponsors of disability plans, as well as retirement plans that provide benefits in the event of disability, may need to amend their claims procedures, depending on the results of this process, which we will continue to monitor.

IRS Warns Of FICA Failures In Nonqualified Plans

The IRS reaffirmed its policy that under a “special timing rule,” FICA taxes payable on nonqualified deferred compensation are generally payable as of the date the amount deferred becomes vested. As a result, FICA taxes are often due prior to payment, which under many plans may not occur until years after vesting. The rule is usually advantageous to taxpayers, as the largest component of the FICA tax, the non-Medicare old age, survivors and disability portion, or social security tax, is not imposed on earnings in excess of the Social Security wage base. That base in 2017 was $127,200 and is $128,400 in 2018.

To the extent that a participant’s deferred compensation becoming vested during a year, together with the participant’s other wages, is above the wage base, the excess escapes both the employer and employee 6.2 percent social security tax. However, failure to include the deferred compensation as FICA income at the time of vesting will require taking it into account at the time of payment. Payment, however, may extend over a period of years after the participant has retired and no longer has other earned income to apply against the wage base, resulting in unnecessary and excessive FICA payments. An additional benefit of complying with the special timing rule is that any subsequent income attributable to deferred compensation amounts included for FICA purposes at vesting escapes social security tax entirely. Taxpayers are cautioned that while the special timing rule can be invoked after a failure to timely apply it, this opportunity goes away once the limitations period for correcting reports and payments of FICA taxes has expired. That time period is generally three years.

Penalties For Hipaa Security Breaches Mount

The U.S. Department of Health and Human Services (HHS) continued in 2017 to mandate corrective action and in many cases impose substantial civil monetary penalties for violations of the HIPAA privacy and security rules:

- A nonprofit hospital system in Florida paid $5.5 million for failing to terminate access rights and monitor information system activity after login credentials of a former employee at an affiliated physician’s office were used to access protected health information (PHI) of over 100,000 people.

- A first-ever settlement based on the untimely reporting of a data breach of unsecured PHI cost an Illinois health care network $475,000 following the disappearance of paper-based operating room schedules, which included PHI of more than 800 individuals.

- An Illinois health care provider paid $31,000 for failing to have a HIPAA-compliant Business Associate Agreement with a company that stored records containing PHI of the provider’s patients.

These violations and many others addressed by HHS during the past year illustrate the importance of following the HIPAA privacy and security rules, in all their variations.